Making international business payments can be hectic if you don’t have a good online transfer service. There are a lot of options available in the market such as PayPal, Payoneer, Skrill, Stripe, etc. These all vary in timing, security, cost, and ease of use. Today we will talk about Payoneer.

What is Payoneer?

Payoneer is a global payment service like PayPal which offers a safe way to make a payment, receive payment, or transfer money in your currency. At present Payoneer is available in more than 200 countries with more than 100+ currency options. This makes it a true global leader in fund transfer services. Payoneer is available as prepaid debit cards, international wire transfers, and local eWallets as well. Payoneer can be a good PayPal alternative.

Sign Up for Payoneer and Get $25?

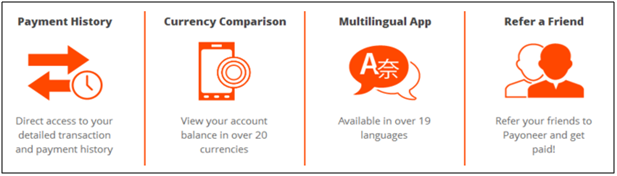

The signup process is very simple. To open an account you must be 18+ age and you need to provide a bank account no to receive the funds. Payoneer has brought an amazing offer for Indian freelancers, when you sign up and use it for a $100 transaction, you will get $25 just for using it. On top of it, if you prefer Payoneer and your referred user completes a $100 transaction, you will get $25 as a referral bonus. So why don't you try Payoneer's "Refer a Friend" sign-up program to make some extra bucks!!!

Once you open an account, you will receive the Payoneer MasterCard debit card which can be activated by using the website. You can use it to withdraw money from a local ATM.

Payoneer India Limitations

· Limit of INR 5,00,000 per single transaction

· Daily Payoneer to Bank transfer limit is 5,00,000

· Monthly transaction limit INR 2,500,000

International Money Transfer

To make or receive funds, you must have a Payoneer Account. The major benefit is you will get US or EUR collection accounts even if you are not present in that country. In simple words, Payoneer provides you a virtual US account and a routing number or a European account and BIC ad IBAN number so that you can receive payments like locals. This seems to be an excellent solution for freelancers or mid-size enterprises or professionals.

Withdrawing Funds

There are 2 ways to withdraw fund

1. Mastercard Debit Card

2. Local Bank Transfer

Payoneer Mastercard Debit Card is worldwide accepted where MasterCard is accepted. The major advantage is your bank account is not mandatory to get this card. Anyone above 18 years of age can apply for this card to receive to transfer money online. As a standard debit card, you can use it for making a purchase or withdraw money from a local ATM. But another hurdle is withdrawing money from ATM will cost you more, yes, an additional fee of $3.15 per transaction is applicable.

Transferring money to the local account is time effective. It takes less than 24 hours to local bank transfer.

Key Features of Payoneer

· Withdraw to Bank Service

· Global Payment Service

· Card Card Service

· Bank Transfer Service

· Credit Card Loading Service

· Mass Payout Service

· US/EURO Payment Service

· ATM is chargeable

· Local bank transfer is less than 24 hours

Conclusion

Payoneer also has a mobile app with 19 language support. You can view your balance in 20 currencies in tabular form which makes your account management job easy. This is available in Google Play and Apple Store. So if you are looking for a better PayPal alternative option, Payoneer is the best suit. 100% Recommended.

No comments:

Post a Comment